NFT Market Research Report

Preface

The birth of Bitcoin introduced concepts such as de-trusting and digital scarcity. Prior to this, the cost of replicating something digitally was almost zero. With the advent of blockchain technology, programmable digital scarcity has also become a reality, allowing us to map the digital world to the real world.

Non-Fungible Token, often referred to as “cryptocurrency collectibles”, takes this idea a step further. Unlike all cryptocurrencies where tokens are created in bulk, Non-Fungible Tokens are limited in number and each one is unique.

Non-homogenized tokens (NFTs) are an important part of the new blockchain-based digital economy. Many projects are currently experimenting with NFTs for a variety of use cases, including gaming, digital identity, licensing, certificates, and artwork. More importantly, they even allow ownership of high-value items to be split.

Today, the distribution of NFTs is becoming easier and easier, with “freshly baked” NFTs coming online every day. In this article, we will provide a detailed overview of NFTs and their uses, as well as an analysis of some of the larger trading markets in the NFT industry.

1. NFT macro analysis

1.1 The development history of NFT

In 1993, Hal Finney introduced the first NFT concept and defined it as crypto trading cards.

In 2012, the first NFT-like token, the Color Coin, was born.

The period from 2014 to 2017 was the development period of NFT, and the “RarePepes” campaign in 2014 gradually brought NFT to the users’ attention.

In 2017, CryptoPunks and CryptoKitties triggered the first wave of NFT boom and raised the public awareness of NFT.

On November 20, 2017, OpenSea was founded

In February 2018, OpenSea was officially launched

In 2018, with the gradual improvement of ERC721, ERC1155 and ERC998 protocols, NFT also becomes mature.

2020 Phenomenal product NBATopshot emerges and quickly captures the market, in addition to the NFT trading market is proliferating.

In March 2021, artist Beeple sold his NFT artwork to Metakovan for $69 million, which was certainly a defining moment for the future of crypto art and announced to the world that NFT is a force to be reckoned with.

In March 2021, Sandbox launched the Beta NFT marketplace, a step towards the creation of a metaverse. Users earn $SAND by selling this through the game platform.

In April 2021, Christie’s auctioned CryptoPunks and 9 CryptoPunks NFTs fetched a total of $16,962,500.

On April 29, 2021, Yuga Labs, an American Web3 company, launched Bored Ape Yacht Club, also known as “Bored Ape”.

In June 2021, a digital lot in Decentraland was sold to virtual real estate developer Republic Realm for $913,000, representing 259 digital lots, for 1,295,000 MANA (MANA is Decentraland’s native token).

In June 2021, CryptoPunks skyrocketed in price and attracted attention.

In July 2021, OpenSea, the NFT trading marketplace, closed a $100 million Series B round of funding led by a16z. According to DuneAnalytics data, OpenSea’s June turnover reached $149 million and volume reached 210,000, both record highs. In addition, the total number of OpenSea users exceeded 140,000, up 19% YoY.

In August 2021, well-known NBA star Curry spent $180,000 to buy a BAYC NFT avatar, a series of stars after the hype of public opinion, the celebrity effect makes the NFT track become hot.

In October 2021, Facebook changed its name to Meta.

In December 2021, rumors of OpenSea’s planned IPO broke out, causing user outrage.

January 10, 2022, NFT trading marketplace LooksRare goes live.

February 15, 2022, NFT trading marketplace X2Y2 goes live.

On April 25, 2022, OpenSea acquired Gem, a decentralized NFT aggregation protocol.

On June 21, 2022, Uniswap announced the acquisition of Genie, an NFT marketplace aggregator.

In June 2022, Magic Eden raised 130 million.

June 2022, Magic Eden launches ETH marketplace.

On July 12, 2022, GameStop, a leading U.S. video game retailer, officially launched its NFT trading platform, GameStopNFT.

2022年8月,Uniswap bought Sudoswap。

1.2 What is NFT?

Non-Fungible Token (NFT), abbreviated as NFT, is known as a unit of data on a blockchain digital ledger and also belongs to the category of cryptocurrencies. Earlier, the term “NFT” was only popular in the ERC-721 standard, which was first proposed in 2017 through the Ether GitHub. Each NFT can represent a unique digital profile that serves as an electronic authentication or certificate of ownership of a virtual good.

Due to its unique, non-detachable, non-interchangeable nature, an NFT can represent a digital file (such as a painting, sound, video, item in a game, etc.) or other form of creative work. While NFT itself can be copied indefinitely, NFT data can be tracked on its underlying blockchain and provide proof of ownership.

1.3 How does NFT work?

Currently, there are various frameworks used for the creation and issuance of NFTs, the best of which is ERC-721, a standard for issuing and trading non-homogeneous assets on the ethereum blockchain.

The standard was later upgraded to ERC-1155, which allows both homogeneous and non-homogeneous tokens to be included in a single contract, creating more possibilities. the standardization of NFT issuance leads to extreme interoperability, ultimately making users the beneficiaries. This essentially means that unique assets can be transferred between different applications with relative ease.

Influenced by Ether, smart contract-enabled public chains such as Coinan Smartchain and Solona have also launched their own NFT standards. The overall functionality is similar to the previously mentioned Ether standard, but the cost is significantly lower than Ether, thus attracting some NFT creators as well.

As with other blockchain tokens, NFT is also stored at wallet addresses. It is worth noting that even the issuer of NFT cannot copy or transfer it without the owner’s permission.

NFT can be traded on open marketplaces such as OpenSea, Looksrare, X2Y2, etc. Such markets connect buyers and sellers, and each token is unique in value. As the supply and demand changes in the market, the price of NFT goes up and down.

1.4 What is the value of NFT?

As a major development segment in blockchain, NFT has several values.

Basic value

NFT collectibles have a certain collection value and ornamental value, bringing the user who collects the work a sense of satisfaction in his heart, and the embodiment of external vanity, etc. The unique NFT sequence designed by the team through their own characteristics and with care is the basis for its development, but for practical applications of NFT, such as proof of use rights, property certificates, etc.,its aesthetic value is less important.

Practical value

Some NFT collections are not only used for collection, but the project team is bound to continuously empower these NFTs to have unique functions in special scenarios for the continued development of this project. In essence, the project team hopes to cast a certain IP image through its NFT items, generating a radiating effect from the center to the periphery.

1) Participation in games. Some of the NFT collectibles, such as cards and meta-universe assets, can be used as “tickets” to participate in games, while others are relatively complex and can be used to expand additional features and experiences in games to increase user playability, for example, the land in SANDBOX can be used to carry out official or private events, etc.

2) Membership privileges. For example, CryptoPunks project, people who love the project naturally form a community, anyone can participate, but users who have NFT can get some benefits from time to time (such as lottery, airdrop, etc.).

3) Digital identity symbols. With the development of digital society and the increase in network communication time, identity symbols and images have more applicable scenarios and gradually become a real and expanding demand. The most emblematic of this characteristic is the NFT avatar collection, and CryptoPunks have now become a symbol of identity and status. It is like a “ticket” to join the “high society”, with the “ticket” can enter the circle, and get the opportunity to exchange and discuss with other users who also have the NFT, etc.

4) Derivative activities. At present, the Bored Ape Yacht Club community has developed content such as anime production and games. Although the project did not plan for this area at the beginning, as the community became more autonomous, it began to broaden its path in new directions, and also promoted a series of activities under the brand.

Historical Value

The historical context of the creation of the NFT collection reflects the time period and the historical significance of its creation. Its development is usually accompanied by the establishment of a community, then the precipitation of knowledge, and finally the perfection of consensus can become a unique community culture, and will also become one of the historical values mapped by the NFT.

1.5 NFT trading performance

1.5.1Trading Volume Overview

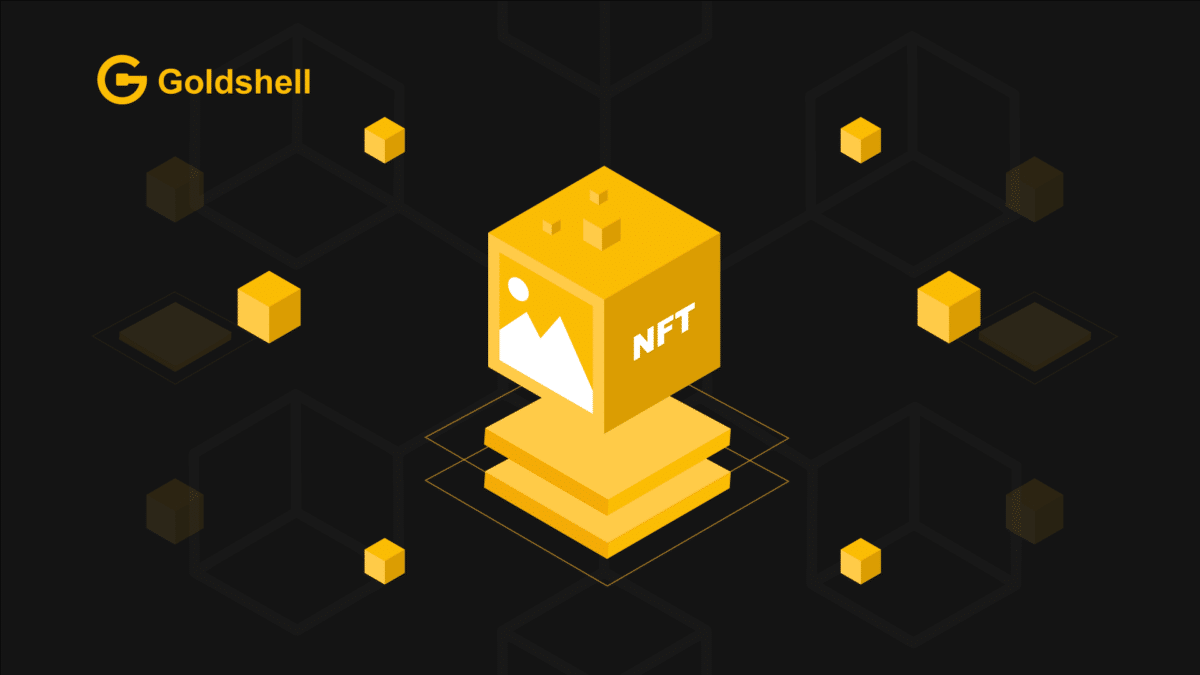

According to nonfungible.com, the NFT market saw a significant drop in trading volume (in USD) of approximately 25% in Q2 2022 compared to Q1, with global trading volume of only approximately $8 billion in Q2, due to the global economic environment and falling cryptocurrency markets.

It’s not just the dollar trading volume that has fallen. So did the number of buyers and sellers, as well as the number of sales. These declines came primarily from NFT programs that have lost interest since the beginning of the year, with only head NFT programs currently retaining some heat.

The CryptoPunks, Meebits and Bored Ape Yacht Club families alone account for 30% of the global NFT market’s dollar trading volume. As a result, market concentration appears to be occurring in the first quarter of 2022 for projects owned by Yuga Labs.

1.5.2 Public Chain Trading Performance

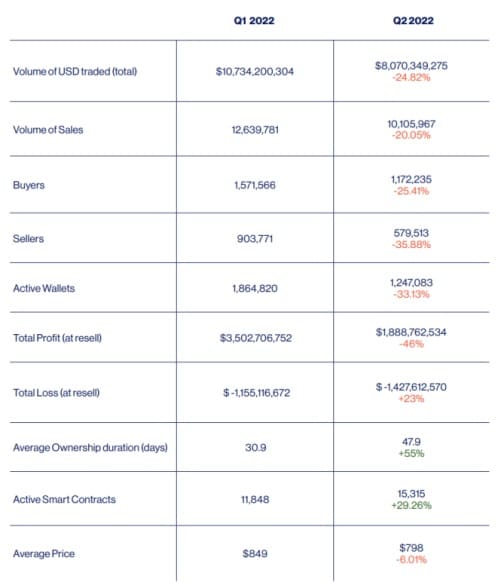

According to cryptoslam statistics, Ether is the largest blockchain in terms of NFT transactions, with $29.1 billion in NFT transactions on the Ether chain as of Aug. 10, seven times more than the second-place Ronin chain (whose main NFT project is Axie Infinity).

The competition of public chains in the NFT industry is showing a swarm, with eight public chains exceeding $100 million in NFT transactions, namely Ether, Ronin, Solana, Flow, Polygon, WAX, Avalanche and Fantom, among which Ronin, Flow and WAX are public chains built for NFT. These three public chains built for NFT rank the top three of all public chains in terms of the number of NFT transactions. Flow ranks first with 22.559 million transactions, and WAX and Ronin rank second and third.

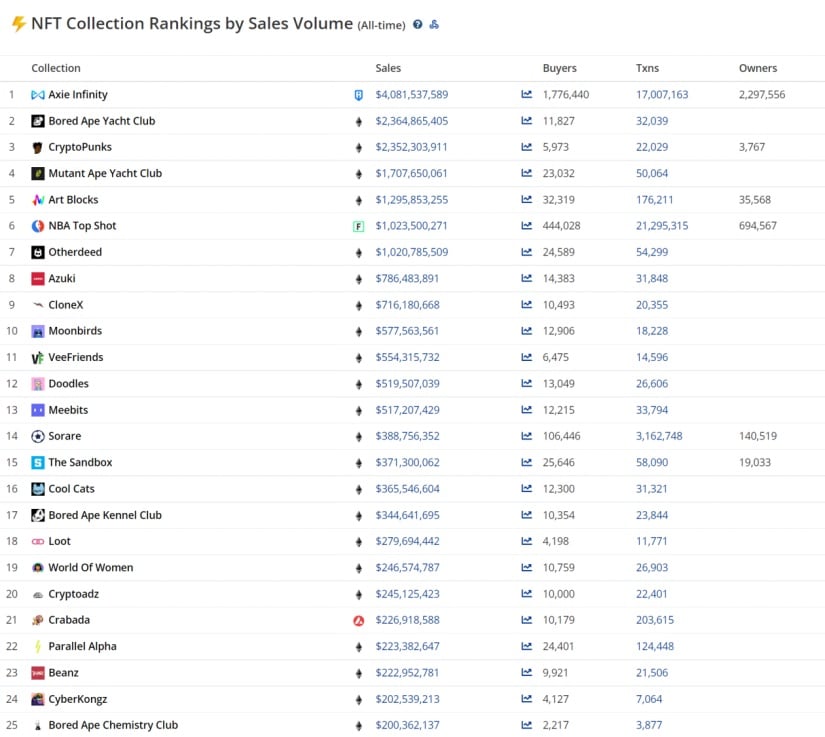

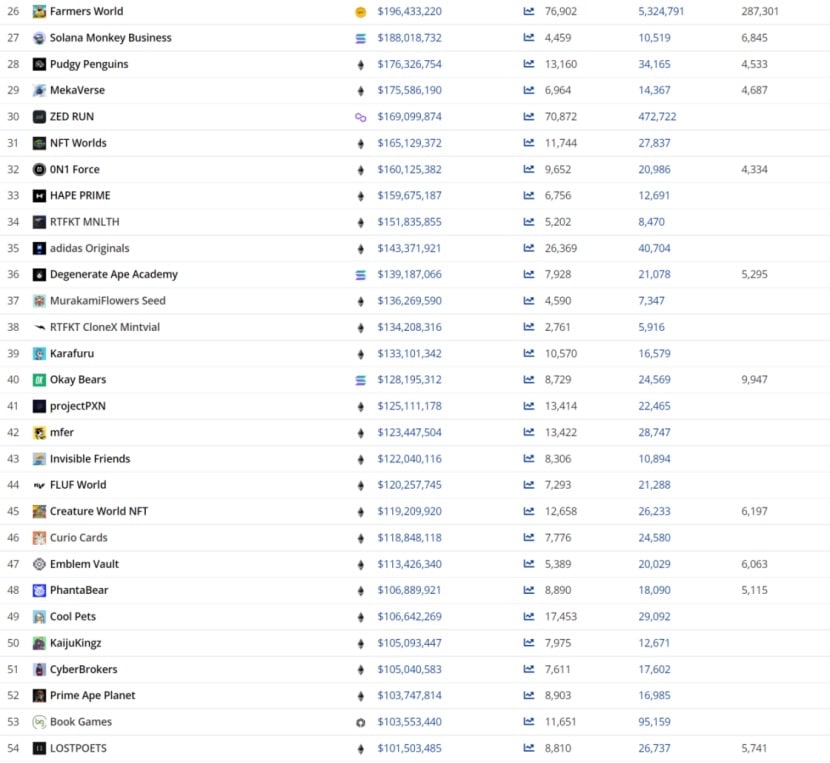

1.5.3 Transaction volume of head NFT projects

As of August 10, there are seven NFT projects with transaction volume exceeding $1 billion, namely Axie Infinity ($4.08 billion), Bored Ape Yacht Club ($2.36 billion), CryptoPunks ($2.35 billion), Mutant Ape Yacht Club ($1.7 billion), Art Blocks ($1.29 billion) , NBA Top Shot ($1 billion), Otherdeed ($1 billion).

Including these seven projects, there have been 54 NFT projects that have exceeded $100 million in deal volume.

Looking at the recent week’s headline NFT project transaction volume, the NFT market has been flat in recent weeks, with data from August 10 showing that among the top 10 projects in terms of weekly transaction volume, eight projects were up less than 30% year-over-year. The biggest gainer was Rare Apepe Yacht Club with a 1,032.13% increase.

2.NFT trading platform development

2.1 The head NFT trading platform trading volume

NFTGo data shows that as of Aug. 22, comparing NFT market transactions in the past year, OpenSea ranked first with a trading volume of $29.425 billion. LooksRare ranked second with a trading volume of $3.435 billion.

NFT trading platform X2Y2 ranked third in terms of trading volume with $640 million. Aggregation trading platforms Gem and genie followed closely behind.

OpenSea is the absolute dominant player in the current NFT trading platform.

OpenSea hit a new high of $4.49 billion in monthly trading volume in January this year, and the trading volume in February, March, April and May all exceeded $2 billion. However, from the trading data of the last three months, due to the decline in market conditions, the trading volume and liquidity of NFT have decreased significantly, of which OpenSea’s trading volume in the last three months was only $1.766 billion, a significant decline in trading volume compared to the previous.

For other exchanges, as X2Y2 started implementing transaction mining in April, X2Y2’s trading volume rose sharply in the last three months, surpassing LooksRare in second place with $235 million in trading volume, while LooksRare ranked third with $219 million.

Aggregation trading platforms Gem, Element and sudoswap ranked fourth, fifth and sixth. Among them, Element and sudoswap’s expected coin offerings also contributed to their trading volume.

Data Source:https://nftgo.io/zh/analytics/marketplace

2.2 NFT trading platform features

The NFT trading platform is a basic function for creators to create and launch NFT works. Both project owners and ordinary users can create NFTs through the NFT trading platform and wait for buyers to buy them.

Take OpenSea as an example, OpenSea launched the “Collection Manager” function in 2020, users can freely create NFT works, no Gas fee can be online NFT works. NFT trading platform to get promotion and expand the group of NFT holders.

Trading: Trading is the basic function of the NFT trading platform, buyers can make offers to sellers, and both sides reach a transaction price. When NFT projects are hot, sellers hope to sell NFT at a high price within the acceptable range of the market. rising NFT transaction prices drive up NFT floor prices. During the transaction process, the NFT trading platform will receive a certain transaction commission from which the creator can determine the royalty. Transaction costs mainly include platform transaction commissions, royalties, Gas fees, etc.

Transaction Aggregator Bulk Transaction: The transaction aggregator supports users to buy NFTs issued by all platforms. transaction aggregators Genie and Gem have the function of bulk transaction, users can buy NFTs in bulk from the market by setting the budget and the NFT items they want to buy. one transaction contains multiple NFTs, which reduces the transaction cost and the time cost of searching for NFTs.

Platform token pledge: There are two main ways for users to pledge platform tokens. The first is simple single coin pledge, take LooksRare as an example, LOOKS holders get LOOKS or WETH rewards by pledging LOOKS tokens. The second is Yield Farming, where the holder gains by providing liquidity to the liquidity pool, such as X2Y2.

Social function: The NFT trading platform is a bridge between creators and fans. Creators with certain influence create accounts in the NFT trading platform, publish NFT works on the platform, and attract fans to buy NFT works.

NFT works are very suitable for dissemination through social media. In the process of social media dissemination, NFT creators’ influence is enhanced and fan communities are gradually formed.

2.3 NFT trading platform’s core competencies

1、Pending order volume (liquidity)

NFT liquidity is an important issue encountered in the development of the NFT industry. Here we break down the NFT exchange traffic into two parts: buyer traffic and seller traffic.

A) Buyer traffic

Aggregators allow new traffic solutions for the NFT market, but NFT exchanges should also have buyer traffic that is unique to them.

Gem, Genie and other aggregator platforms have emerged to allow small exchanges to solve the problem of buyer traffic. As long as the pending orders on NFT trading platforms are relatively reasonably priced, aggregators will put them on the shelves. However, with the amount of people trading in the market and the overall liquidity declining, users tend to gather to larger trading platforms, and small trading platforms without enough exclusive traffic are often the first to be eliminated.

B) Seller traffic

Compared to the buyer traffic that can be attracted by aggregators, seller traffic is a major problem and a major competition point for NFT exchanges.

In order to enhance the platform’s seller traffic, some exchanges have been incentivizing sellers to hang orders through concessions, such as looks’ hang order rewards, X2Y2’s trading mining and so on.

In addition to incentives, active promotion and cooperation with NFT programmers and keeping up with real-time hotspots are also important channels to accumulate seller traffic. From the “liver white” to “Free Mint”, NFT market hotspots continue to emerge. If the exchange can actively cooperate with the project side, let the project side cooperate with the guidance, let NFT holders to specific exchanges to hang orders, if encounter a burst can play a significant role in attracting traffic.

2、User experience (product iteration capabilities)

From Crypto Kittiy to today, NFT has entered a phase of rapid development, with new hotspots, new narrative logic, and new demands born every day. Therefore, it is necessary for the project party to be able to constantly iterate the product, understand the users and meet their needs, so that the ability to iterate the product can be converted into a good product user experience and win in the industry.

3、Social Attributes

NFT is an important medium to connect between creators and fans, creators are paying more and more attention to the role of fan economy and community, NFT creation and trading are accelerating the speed of dissemination in social media. Currently socialized NFT trading has already seen some cases in crypto art and music NFT trading platforms, and in the future NFT trading will be more integrated with SocialFi.

2.4 The development direction of NFT trading platform

At present, NFT trading platforms generally show the following trends: multi-chain development, functional aggregation, NFT+SocialFi, and NFT liquidity enhancement.

Multi-chain development: Although NFT trading is currently concentrated on the ethereum chain, NFT trading platforms with certain trading volume have also emerged on public chains such as Solana, Flow, Polygon, WAX and BSC, occupying a certain market share. Some NFT trading platforms choose to deploy on multiple public chains to expand their user base.

Function aggregation: NFT trading platform adds NFT project data, NFT project preview, batch trading and other functions in addition to the trading function, providing users with NFT one-stop service and continuously adding new functions according to user demand.

NFT+SocialFi: NFT trading platform builds a bridge between creators and fans, creators publish NFT, spread it through Web3 social applications, and form NFT fan communities with NFT as a link.

NFT liquidity enhancement: fragmented NFT trading, NFT liquidity mining, NFT collateralized lending and other NFT financialization applications converge with NFT trading platforms, and NFT trading platforms with NFT liquidity solutions emerge.

The development of NFT trading platform is significant for the whole NFT industry, as a place for NFT project presentation and trading, the self-optimization of NFT trading platform will bring project parties, creators, buyers and sellers closer together and promote the benign development of the NFT industry.

2.5 Introduction of NFT trading platform

Ⅰ Integrated NFT trading platform

2.5.1 OpenSea

Project Introduction

OpenSea is the first and largest NFT trading marketplace, with functions including making and putting online NFT, trading NFT, managing NFT, and searching NFT project trading information.

Project History

November 20, 2017-OpenSea was established

February 2018-OpenSea officially launched

May 2018-OpenSea closes a $2 million seed round with investors including Blockchain Capital, 1confirmation, Founders Fund, Foundation CapitalChernin Group, Coinbase Ventures, Blockstack and Stable

March 2021 – OpenSea receives $23 million in Series A funding led by a16z, with participation from Cultural Leadership Fund

July 2021-OpenSea closes $100M Series B round

Dec 2021 – Rumors of OpenSea’s planned IPO spread, causing outrage among users

January 2022-OpenSea raises $300 million

April 2022-OpenSea launches SOL trading marketplace

April 2022-OpenSea acquires decentralized NFT aggregation protocol Gem

Project Advantages

1) Brand First Mover Advantage: Through early partnerships with multiple projects/artists, OpenSea quickly established its NFT supply market and became the first choice for projects to go live.

2) User experience optimization: OpenSea allows “custom” filtering and sorting, changing based on the collection being viewed, so users can refine their search based on that particular collection.

Token Economics

OpenSea has not issued any tokens, but plans to enter the capital market through an IPO.

Investment Institutions

a16z, Connect Ventures, Michael Ovitz, Kevin Hartz, Kevin Durant and Ashton Kutcher.

Media Info

| Official Media | https://www.reddit.com/r/opensea | Quantity |

| https://twitter.com/opensea | 1836877 | |

| https://www.reddit.com/r/opensea | 161447 | |

| Discord | https://discord.com/opensea | 237324 |

Summary

OpenSea has been deeply involved in the NFT track since 18 years and actively integrated with various better developed NTF projects, and has grown to become the most comprehensive NFT trading platform covering the widest range of categories and the most digital commodities. Of course, OpenSea, although the largest NFT trading marketplace, still needs to continue to work hard to maintain its leading position, while venture capital is still looking for new opportunities in this field and new entrepreneurs will pop up. As for whether such projects can compete with Opensea in the future, we still need to see the subsequent development.

2.52 LooksRare

Project Description

LooksRare is a community-owned NFT marketplace that rewards buyers and sellers for using the platform. looksRare distinguishes itself from similar NFT marketplaces by redistributing platform transaction fees to its consumers and pledgers.

LooksRare differentiates its NFT marketplace from OpenSea in several key ways. The first is the platform transaction fee, which LooksRare charges at 2% compared to OpenSea’s 2.5%. Secondly, it promises to give 100% of all platform fees to those who pledge $LOOKS.

Finally another key point about the LooksRare market is how it handles derivative NFT programs. That is, for NFTs that are clearly modeled after existing NFT series, LooksRare’s position is that it will not take down or freeze the status of derivative projects, provided that “they are not acting in bad faith”.

Project History

January 10, 2022 – LooksRare goes live

April 20, 2022 – Allocated part of the proceeds from the original “trading mining” to the pending order rewards

Project Advantages

Compared to OpenSea, LooksRare has the following advantages.

1) Lower fees: LooksRare charges a 2% fee on all NFT transactions, which is lower than OpenSea’s 2.5% fee.

2) Mixed purchase with WETH or ETH: On OpenSea, users can only use ETH to purchase when they want to, but if they only have WETH on hand, they need to consume expensive Gas fee for conversion, while LooksRare can mix payment.

3) 100% of platform fees are returned to LOOKS pledgers: In OpenSea, all transaction fees will only become the numbers on the financial report, but LooksRare rewards LOOKS pledgers with fees, so users can share the proceeds of LOOKS and WETH, which will attract more users to pledge LOOKS.

4) One-click offer: For many users who want to buy NFT, they actually do not care much about how long they buy, as long as they have it, so LooksRare allows users to do a one-click offer on the NFT series you like, very convenient. This will also increase the liquidity of this series of NFT.

5) Instant royalty income for creators: OpenSea is usually received every two weeks, while LooksRare is received at the moment of sale, allowing creators to get liquidity more quickly.

Token Economics

LooksRare’s token is LOOKS, 1 billion in total, of which 75% is allocated to the community (12% airdrop, 18.9% pledge rewards, 44.1% transaction rewards) and the remaining 25% is allocated as follows, 1.7% liquidity management, 3.3% strategic sales, 10% founding team, 10% treasury.

Users pledge Token to earn platform fees (WETH) and block rewards (LOOKS); trade specific NFT series to earn LOOKS Token; and also provide ETH-LOOKS liquidity to earn LOOKS.

| Token Volume | Market Cap. | Token Value | Dex/Cex | CMC Rank |

| 1000000000 | $186,144,505.84 | $0.4 | Gate and other 41 exchanges | 231 |

Investment Institutions

LooksRare does not have any institutional investors.

Media Info

| Official Media | https://looksrare.org | Quantity |

| https://twitter.com/looksrare | 241998 | |

| Github | https://github.com/looksrare | / |

| Discord | https://discord.gg/looksrare | 50249 |

Summary

Looksrare is undoubtedly the most likely project to challenge the status of Opensea recently. Compared to SOS, his product and promotion are more mature and better prepared, and he is less likely to fall into a wave. Finally, what everyone needs to think about is that since the emergence of Opensea, countless agencies have tried to challenge his existence, and his drawbacks are obvious, but why is he still standing and even getting stronger? I hope LooksRare will give us an answer.

2.5.3 X2Y2

Project Description

A community-centric NFT exchange built to break the monopoly of opensea, focusing on fair sales, NFT listings and minting concepts.

Project History

January 26, 2022-Litepaper public

January 28, 2022 – X2Y2 official website launched and Discord community launched

February 14, 2022 – Marketplace beta public, whitelist statistics start

February 14, 2022 – X2Y2 Initial Liquidity Offering

Feb 15, 2022-Destruction of all LP Token after additional LPs

February 15, 2022 – Open Airdrop Pickup, Open ILO Participating User Linear Unlock

February 15, 2022 – Marketplace officially goes live, X2Y2 Staking goes live

February 16, 2022 – Initial distribution of front day market fees

April 1, 2022 – X2Y2 cancels the pending order bonus and replaces it with “trading mining”

Project advantages

(1) X2Y2 is a low-cost strategy, X2Y2 charges 0.5%, while OpenSea charges 2.5%.

(2) 100% of the fees are paid back to the users.

(3) X2Y2 in order to improve the user experience, the introduction of a user-friendly batch trading and browsing NFT function: the following

Batch shelving: shelving up to 20 NFTs at a time.

Bulk purchase: buying NFTs in bulk at one time.

Real-time notifications: send notifications/emails about the activity of your items.

Rarity integration: browse the rarity of NFT without installing extensions.

Token Economics

X2Y2’s token is X2Y2 with a total of 1 billion pieces, of which 65% pledge rewards, 2.8% airdrop rewards, 9.8% mining rewards, 10% founding team, 1.5% liquidity management, and 1.5% initial initial liquidity provision.

In addition to airdrop/purchase, users can earn X2Y2 rewards by.

1) Pledging: Users receive a daily X2Y2 bonus and a WETH fee bonus for the previous day’s linear distribution in accordance with Staking’s X2Y2 ratio.

2) Transaction Mining: Users divide the 624902 X2Y2 tokens distributed each day in proportion to their personal transaction fees and total transaction fees in X2Y2.

| Token Volume | Market Cap. | Token Value | Dex/Cex | CMC Rank |

| 1000000000 | $32,613,129.72 | $0.18 | MEXC and other 9 exchanges | 2947 |

Investment Institution

Anonymous team, offering through ILO, no institutional investment.

Media Info

| Official Media | https://x2y2.io/ | Quantity |

| https://twitter.com/the_x2y2 | 94565 | |

| Discord | https://discord.com/invite/x2y2 | 23488 |

Summary

As the second largest NFT exchange on Ether, X2Y2 has improved the trading experience and handled security issues better. In terms of coin price X2Y2’s incentives tend to be more spread out and do not cause too much concentrated selling pressure. In summary, it is worth paying attention in the long term and getting involved at low levels.

2.5.4 Magic Eden

Project Description

MagicEden, built in September 2021, is an NFT trading marketplace for the Solana ecosystem, providing users with NFT casting and trading services, including NFT issuance, data analysis, asset management, etc. MagicEden has gained a foothold on the Solana chain thanks to its functionality on the one hand, and on the other hand, by offering a lower rate than competing pairs when benchmarking against OpenSea, the largest ethereum NFT trading platform. On the other hand, it gives up a lower handling fee rate than the competing pair when benchmarking against the largest ethereum NFT trading platform OpenSea. On OpenSea, the handling fee for each NFT transaction is 2.5% of the transaction amount, while Magic Eden sets this rate at 2%, and the NFT onboarding fee is 0, and supports creators to set royalties within the high limit of 10%.

Project History

September 17, 2021 – Magic Eden officially launches

March 2022 – Magic Eden announces a $27 million round of funding from Sequoia Capital, Paradigm, Greylock, Alameda Research, and Solana Ventures.

March 2022 – Magic Eden announces it will launch MagicDAO to encourage community participation in the governance of the platform

March 2022- Magic Eden surpasses OpenSea in daily trading volume as Solana NFT heats up

June 2022 – Magic Eden raises $130 million in Series B funding led by Electric Capital and Greylock

Project Advantages

1) Solana-based high throughput and low fees bring a cheaper and faster interaction experience to users.

2) Magic Eden Launchpad, the NFT initial launch platform, which provides creators with technical tools, marketing support, and an automated go-to-market feature through which creators can launch their new projects. It provides an easy-to-use NFT casting window for creators who are less familiar with technology.

3) Community-based governance, MagicEden airdrops Magic Ticket to marketplace users, holding users can get additional rewards and participate in governance.

Token Economics

Magic Eden has not issued its own tokens, and has not disclosed any subsequent token issuance plans.

Investment institutions

Solana Ventures, Greylock, Electric Capital, Paradigm, Sequoia Capital, Lightspeed Venture Partners, 44 Capital Management

Media info

| Official Media | www.magiceden.io | Quantity |

| https://twitter.com/MagicEden | 335925 | |

| Discord | https://discord.com/magiceden | 78748 |

Summary

Magic Eden, born in September 2021, provides NFT casting and trading services mainly for users within the Solana on-chain ecosystem.

Magic Eden has also been leaning on the product experience, providing not only the basic functions of NFT casting and trading, but also product segmentation, such as building Launchpad, the NFT initial distribution platform – providing creators with technical and marketing support tool components to make it easier for creators to launch their new projects. Added EdenGame, a dedicated section for game NFT assets – a one-stop platform for game developers and gamers, through which in-game NFT assets can be traded.

Compared with OpenSea for Ether, Magic Eden is more closely aligned with Solana chain, which is completely built on the chain, starting from NFT trading and gradually evolving into a one-stop NFT platform, integrating trading, distribution, game portal and asset management.

2.5.5 Rarible

Project Description

Rarible is a comprehensive NFT trading platform that includes a wide range of NFT assets. rarible issues weekly RARI token rewards to platform traders, and users can also participate in platform governance.

Project History

Early 2020 – Alex Salnikov and Alexei Falin found Rarible

July 16, 2020 – Rarible launches market liquidity mining with the governance token RARI

July 20, 2020 – First airdrop is conducted and 1 million RARI is allocated to NFT holders on Rarible

July 20, 2020 – Crypto institution CoinFund invests in Rarible for an undisclosed amount

February 24, 2021-Rarible closes $1.75M seed round

March 6, 2021-US hip-hop group WuTangClan releases NFT on Rarible

May 25, 2021 – American hip-hop group WuTangClan releases NFT on Rarible

Project Advantages

1) Open NFT marketplace, anyone can create an NFT without permission, whether it represents a piece of art, intellectual property or something completely different.

2)Good user experience, Rarible not only has a ranking of popular NFT projects on the home page, but also sets up a ranking of NFT buyer data, which is convenient for users to monitor which NFT giant whales are buying NFT recently and judge the current heat of the NFT market.

Token Economics

Rarible’s native token is RARI, with a fixed total of 25 million tokens, of which 60% are mined for liquidity, 10% are airdropped, and 30% are allocated to investors and teams. 75,000 tokens are distributed weekly by Rarible, and users who buy and sell transactions on Rarible each receive 50% of the allocated amount.

RARI tokens currently serve the following main purposes.

1) Governance: RARI holders can make collective decisions and vote on various matters such as system updates, transaction fees, new features, and future developments.

2) Governance: vetting creators on the platform.

3) Featured Artwork: RARI token holders can vote on featured artwork in the platform to decide who can get a boost from the platform to create fine creators and works.

| Token Volume | Market Cap. | Token Value | Dex/Cex | CMC Rank |

| 25,000,000 | $29,556,714.24 | $3.13 | Coinbase and other 25 exchanges | 524 |

Investment institutions

CoinFund, Coinbase Ventures, 1KX, LedgerPrime, ParaFi Capital.

Media info

| Official Media | https://rarible.com/ | Quantity |

| https://twitter.com/rarible | 489022 | |

| Discord | https://discord.com/rarible | 57251 |

Summary

Rarible is a comprehensive NFT trading platform built on ethereum. Relying on the innovative market liquidity mining method in the early stage, it has quickly grabbed a considerable part of the market share, and the overall scale of the ecology is developing well at present. The overall architecture of the product is reasonable and easy to use, but there is still some room for improvement. If the product continues to maintain its innovative ability and operate successfully, it has a chance to become a competitor of OpenSea in the future. Therefore, it is worth watching.

Ⅱ NFT Transaction Aggregator

NFT transaction aggregator facilitates users to “sweep”, compatible with all platforms so that users can complete all operations on the NFT transaction aggregator, and the transaction aggregator only requires users to enter the budget, quantity, target NFT items and other information, faster and lower transaction costs.

In the NFT aggregated trading track, the representative products are Genie , Gem and Element respectively.

Genie

Genie is the first platform to lay out an NFT aggregator application, which officially launched in November 2021 and mainly supports NFT asset bulk buying and selling functions. On June 22nd of this year, Uniswap Labs announced the acquisition of Genie.

Currently, Genie has integrated multiple NFT trading marketplaces such as OpenSea, Rarible, LooksRare, x2y2, etc. Users can purchase multiple NFTs from multiple marketplaces in a single transaction and reduce Gas fees with the Genie Swap aggregator trading tool.

Genie home page will display the trending hot ranking of NFT items, the overall interface of Genie Swap is simple, the left side is the payment box (sold NFT), the right side is the receiving box (purchased NFT), both sides can add multiple NFTs that you want to sell and buy respectively, the difference is made up by ETH.

Gem

Gem.xyz is an NFT aggregation trading platform based on Ether, which was launched in beta version on December 18 last year. on April 25, OpenSea announced the acquisition of Gem, and after the completion of the acquisition, Gem will still operate as an independent brand.

Currently, Gem aggregates NFT listings from OpenSea, LooksRare, Rarbible, x2y2 and other marketplaces. It hopes to integrate all NFT marketplace listings, so that users no longer need to jump to other NFT platforms to compare prices and trade one by one.

In addition, compared with Genie only using ETH as a means of payment, Gem has done more optimization and upgrading in the means of payment, supporting users to use multiple Tokens for buying and selling NFT, and even supporting the combination of Tokens for payment at the same time. For example, when a user buys NFT and the ETH balance in the wallet is insufficient, the user can pay with a combination of other Ether standard Tokens such as USDC and UNI.

In addition, Gem integrates richer data display functions, including multi-dimensional data of each NFT (price trend, NFT property characteristics, etc.), so users can browse and purchase NFT on various mainstream trading platforms in Gem in one stop.

Element

Element is a community-driven NFT aggregation marketplace, co-founded by serial entrepreneur Wang Feng (founder of Blue Harbor Interactive and Mars Finance) and his long-time technology partner Zhang Hongliang, which completed an $11.5 million angel round led by Sequoia Capital, SIG and Dragonfly Capital in May 2021 and went live in beta in August 2021.

Element provides useful features such as cross-market buying and selling, one-click shopping cart, giant whale tracking, and chain-wide data ranking. It has now aggregated transactions from trading platforms such as Opensea, Looks, X2y2, etc., and nft above ETH, BNB, Polygon, Avalanche, etc. can be purchased in bulk on Element.

In terms of trading mode, Element currently supports different trading services such as British Auction and Dutch Auction.

In terms of transaction fees, Element takes lowering the threshold for users to enter the NFT market as the starting point, with an agreement to save up to 49% on transaction Gas.

Currently, due to Element’s clear announcement that it will airdrop platform users, Element’s transaction volume and number of users in recent March has far exceeded the second largest aggregation market Genie, only forcing GEM, and is expected to become the first largest NFT aggregation market on the ETH chain.

Ⅲ NFT Liquidity Agreement

NFT liquidity is an important issue encountered in the development of the NFT industry, and the NFT liquidity protocol is used to enhance the liquidity of NFT projects by adding ERC20 tokens to NFT in the form of NFT liquidity.

Currently, in addition to fragmented NFT, lending and liquidity mining are also important solutions to enhance NFT liquidity, and these solutions are being integrated into the NFT trading platform.

Fractional

Fractional is a protocol for unlocking liquidity in NFT assets by allowing users to lock NFT assets into a vault of smart contracts and then issue ERC20 tokens for trading.

Unicly

Unicly is a fragmented NFT protocol. Unicly allows users to encapsulate any number of NFTs into a “uToken”, such as decomposing CryptoPunks, Loot and other NFTs into uTokens, establishing a liquidity pool, determining the price and market value of the uToken, and the liquidity provider can trade the NFT-related ERC20 Unicly issues UNIC tokens, and the UNIC tokens are allocated to the liquidity providers of uToken, and Unicly officially gets the platform revenue from the fees through liquidity mining.

Sudoswap

Developed by the founder of NFT project Oxmons based on the 0x protocol, the first generation of the product focuses on NFT OTC services, while the second generation of the product is upgraded to NFT AMM (Automatic Market Maker) protocol sudoAMM, through which users can create a pool of NFT liquid assets to provide liquidity for the liquidity pool NFT-Token, and receive a transaction fee reward. This protocol allows NFT trading users to enjoy lower slippage when swapping between NFT and Tokens.

Sudoswap has now been acquired by Uniswap, joining forces with Genie to provide the foundation for Uniswap’s entry into the NFT industry.

Analysis view

Although the current market has seen a decline in the number of people trading and overall liquidity, market instability has prompted a shift towards investing in more stable blue-chip NFT assets. However, the future development of NFT is still worth looking forward to. In terms of the NFT native market, the NFT ascendancy driven by bored apes will focus on more IP creators, funding and users, and the expectation for NFT is not only for displaying avatars, but games, and peripheral ideas derived from this community.

On the track of NFT trading platform, the current trading market which is directly competing with Opensea is still facing a big test and needs to accumulate strength and build up strength. The pass mechanism may increase user/supplier usage for a short period of time, however, in the long run it will not be able to retain users and thus build a strong barrier. Innovative projects can be considered in the segmented NFT trading market and self-incubation model, bypassing opensea to create a new business model.

If you would like Goldshell Research to consider your project, please send a summary of your project along with a pitch deck and/or whitepaper to [email protected]

Categories

- Analysis (2)

- Announcement (12)

- Event (3)

- News (17)

- Report (17)